Featured

Length Of Average Bear Market

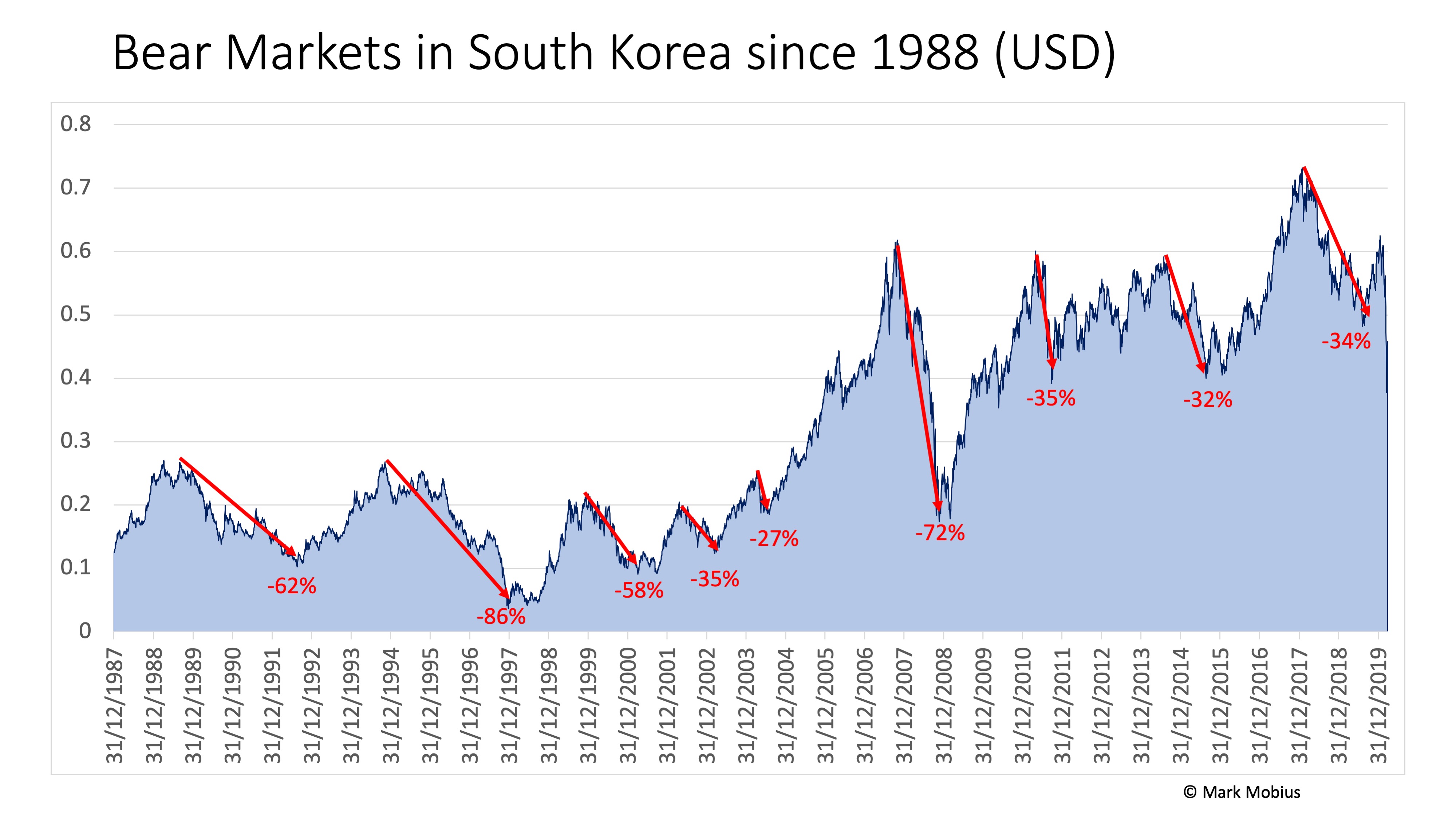

Length Of Average Bear Market. In the average bear market, stocks lost about 35 of their value. These charts of bear and bull markets in the s&p 500 since 1932 illustrate this well—there have 12.

The average length of a bear. The s&p 500 index has fallen an average of 33 percent during bear markets in that time. In the years after the troughs of the bear markets throughout the stock market's history, indexes have generally gained close to half of their previous highs.

The Problem, Of Course, Is That No One Knows When The Bear Market Will Come To An End.

But even that figure is up for debate. Length of an average bear market. Historical bear markets have been as short as one month and as long as 2.8 years!

Based On Historical Data, The Average Length Of A Bear Market Is 289 Days.

When there is no recession, it's 150 days and it drops by around 21 per cent. Let’s be clear, 9.6 months is the average bear market length. The average length of a bear market is 289 days, or about 9.6 months.

That’s Significantly Shorter Than The Average Length Of A Bull Market, Which Is 991 Days Or 2.7 Years.

Right now, last i looked, it was 21%, says frank. Bear markets can be shorter than you think, wsj, mar 8, 2016. If this were an average bear market, we still have a.

The Longest Bear Market Was In 1930 And Lasted For 783 Days.

In the average bear market, stocks lost about 35 of their value. What we do see when the two overlap is a bear market that tends to last longer and fall further. Keep in mind, this is the average.

A Period In Which Prices Of Stocks Increase During A Bear Market.

Eight out of the 15 bear markets broke even in under a year. According to seeking alpha, there have been 28 bear markets since 1928, with an average decline of 35.62%. These charts of bear and bull markets in the s&p 500 since 1932 illustrate this well—there have 12.

Popular Posts

Average Temperature In Iowa In January

- Get link

- X

- Other Apps

Comments

Post a Comment